Banking-as-a-Service (BaaS)

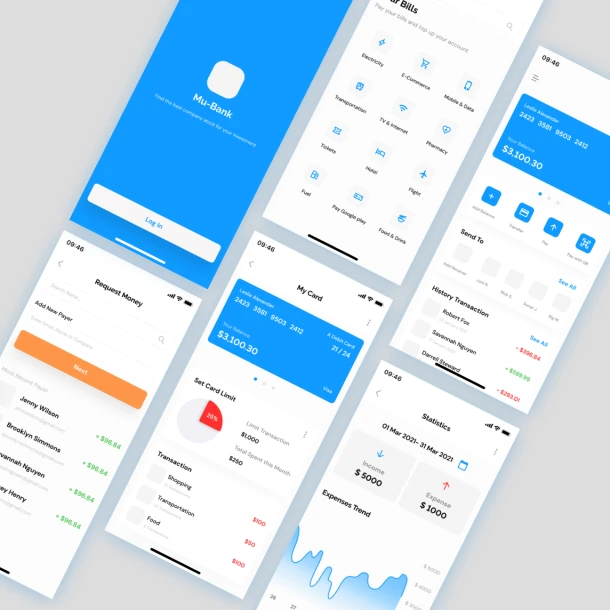

Our consultants can guide you in designing and implementing Banking-as-a-Service (BaaS) platorms tailored to your B2B banking needs.

Our Experience in BaaS Implementation

Our consultants have successfully led the design and implementation of the People’s Group’s and Breinrock’s Banking-as-a-Service (BaaS) platform. These projects exemplifies our ability to deliver robust, API-driven platforms that seamlessly integrate with fintech partners and payment networks while ensuring compliance with stringent regulatory standards.

Key Aspects of Our BaaS Consulting Services

We provide end-to-end consulting services, guiding clients through every phase of their BaaS journey, including:

Strategic Planning:

Developing a clear roadmap for your BaaS platform.

Aligning technical requirements with business goals to meet both current and future needs.

API System Design:

Architecting modular, API-driven platforms for seamless integration with fintech partners.

Reducing implementation time and operational costs through efficient system design.

Payment Integration:

Enabling connections with payment networks such as ACH/EFT, eTransfer, cards, and Bill Payments.

Enhancing customer experience with real-time fund transfers and instant payment options.

Compliance-First Design:

Implementing robust security measures, including encryption, KYC, and AML processes.

Ensuring alignment with regulatory standards such as CDIC (Canada Deposit Insurance Corporation) requirements.

Operationalisation:

Creating an operational framework for settlement, reconciliation, billing, and support.

Collaborating with internal teams to ensure seamless execution and client satisfaction.

Why Choose Fintech Firma for BaaS?

At Fintech Firma, we combine deep technical expertise with practical implementation experience to deliver state-of-the-art BaaS solutions. Our approach ensures that your platform is future-ready, compliant, and capable of meeting the evolving demands of the financial services industry.

Unlock the Power of BaaS

Whether you’re launching a new BaaS platform or enhancing an existing one, Fintech Firma provides the strategic guidance and technical expertise you need. Let us help you deliver innovative, efficient, and customer-focused banking services.

Case studies

Platform for a Leading Canadian B2B Payments Bank

Implementing Banking-as-a-Service (BaaS)

See full case study